Why Closing Costs Matter

Purchasing a property, particularly in a foreign land, is a thrilling yet pivotal moment in one's life. As with any significant investment, you're performing the due diligence. Diving deep into the details includes unraveling the intricacies of closing costs. You don’t want any surprises. So, how does Costa Rica calculate closing costs? What elements do they encompass? And who shoulders the bill?

Comparing Costa Rica to North America: The Differences

When it comes to closing costs, you'll find that Costa Rica's tend to surpass those in the United States or Canada. This can be attributed to various factors, with Costa Rica's tax collection method being a primary one. The silver lining is the transparent and simple calculation process, which is always based on a percentage of the property’s value. A significant point to highlight: Historically, there has been some laxity towards property tax evasion. Costa Rica has recognized this and is actively addressing the challenge. Our golden rule? Always ensure your transactions are transparent and legitimate.

When it comes to closing costs, you'll find that Costa Rica's tend to surpass those in the United States or Canada. This can be attributed to various factors, with Costa Rica's tax collection method being a primary one. The silver lining is the transparent and simple calculation process, which is always based on a percentage of the property’s value. A significant point to highlight: Historically, there has been some laxity towards property tax evasion. Costa Rica has recognized this and is actively addressing the challenge. Our golden rule? Always ensure your transactions are transparent and legitimate.

Breaking Down the Components: What Makes Up Closing Costs

In Costa Rica, the calculation of closing costs breaks down into 4 different components: The transfer tax, national registry & documentary stamps, the legal fees, the escrow fees and the real estate commission.

1. Transfer Tax, National Registry & Documentary Stamps

The transfer tax taxes and stamps to transfer the shares of a corporation are around 1.5% while it is 2.4% to transfer a property. To address potential issues with transfer tax evasion, Costa Rica employs a strategy where the calculation is based on the greater of two amounts: the contracted sales price or the registered fiscal value in Colones, at the rate of the day it is calculated. This tax is usually shared equally between the buyer and seller but it is subject to negotiation. These elements are predominantly determined as a percentage of the overall property value, making the calculation process relatively straightforward, even if there isn't a fixed rate for these costs.

Your property purchase in Costa Rica might come with some additional costs, including topographical evaluation, property inspection, transfer of an electric and water meter if done by your attorney, legal fees such as affidavit, power of attorney, opening a new corporation, property taxes and HOA fees that would be calculated proportionally with the closing date, etc. Those extra fees typically vary from US$ 2,000 to 5,000.00 and must be evaluated by your agent and attorney based on your purchase. The sellers may also have to pay a tax on capital gain within 30 days after the closing. Most sellers will ask their attorney to have it held in escrow from the proceed of the sale so it is ready to be paid after the closing.

2. Legal Fees: The Role of Notaries in Property Transfer

Did you know two intriguing aspects of Costa Rica's legal landscape? Firstly, there's a penchant for tiered fee structures. Secondly, only attorneys can ascend to the role of notaries. More intriguingly, becoming a notary is considered a professional elevation from just being a lawyer.

Did you know two intriguing aspects of Costa Rica's legal landscape? Firstly, there's a penchant for tiered fee structures. Secondly, only attorneys can ascend to the role of notaries. More intriguingly, becoming a notary is considered a professional elevation from just being a lawyer.

A key point for those looking to buy property in Costa Rica: to become a public notary, one must first be an attorney affiliated with the Costa Rican Bar Association (el Colegio de Abogados). After practicing law for at least two years, they can then pursue a specialized legal degree in notary and registry law. Simply put, a Public Notary in Costa Rica is an attorney with expertise in property transfers.

This translates to a straightforward principle: only a notario público (public notary) holds the legal authority to oversee property transfers, like purchasing a home. If you're yet to secure an attorney, it's beneficial to opt for a firm (un bufete) boasting a notary public. This choice will streamline your legal journey in Costa Rica.

The buyer's attorney fees adhere to a fixed tiered fee structure:

- Up to 10,000,000 Colones: 2.0% plus IVA

- 10,000,001 to 15,000,000: 1.50% plus IVA

- 15,000,001 to 30,000,000: 1.25% plus IVA

- Above 30,000,001: 1.00% plus IVA

The seller's attorney will typically charge a minimum of 0.50% plus IVA to represent a client, and it can be more if extra work is required. There are cases where the existing corporation of the seller has to be closed, or some books have to be updated. It is important to check with your attorney to get the full picture of your future costs.

3. Escrow Fees: Why do we Need an Escrow Company?

Using an escrow company is a smart decision in various situations involving financial transactions or the exchange of valuable assets. In essence, an escrow company acts as a safeguard in financial and asset transactions, ensuring that both parties fulfill their obligations before the final exchange takes place. The Escrow company will ensure that no ones gets paid before the closing, unless it has been specifically required in your purchase and sale agreement. This level of security and trust is invaluable in Costa Rica real estate transactions, and your REMAX Agent will be able to recommend a few good companies that have been proven reliable, fast and efficient. The Escrow fees are typically shared equally by the Buyer and Seller and vary from 0.20% to 0.34% of the purchase price (with a minimum amount of a 800.00-1,000.00 per transaction).

Using an escrow company is a smart decision in various situations involving financial transactions or the exchange of valuable assets. In essence, an escrow company acts as a safeguard in financial and asset transactions, ensuring that both parties fulfill their obligations before the final exchange takes place. The Escrow company will ensure that no ones gets paid before the closing, unless it has been specifically required in your purchase and sale agreement. This level of security and trust is invaluable in Costa Rica real estate transactions, and your REMAX Agent will be able to recommend a few good companies that have been proven reliable, fast and efficient. The Escrow fees are typically shared equally by the Buyer and Seller and vary from 0.20% to 0.34% of the purchase price (with a minimum amount of a 800.00-1,000.00 per transaction).

4. Real Estate Commission

Engaging the services of a REMAX Agent is a good choice for various compelling reasons. The REMAX team has a large understanding of the local real estate landscape, market dynamics, property values, and neighborhood specifics. This invaluable local knowledge enables the agents to locate properties that align with their buyer's requirements. Additionally, they will save you time and hassle by managing labor-intensive tasks such as property searches, viewings, and communication with various stakeholders throughout the transaction process.

REMAX Real Estate Agents also access ALL property listings through their own multiple listing services (MLS), streamlining your search for the ideal property. Furthermore, their established professional networks encompass inspectors, escrow companies, and legal experts, ensuring a seamless and trustworthy transaction experience. They offer guidance throughout the intricate process, ensuring that you meet all the legal and financial requirements. In addition to these advantages, they will provide critical market analysis and property valuation insights, enabling you to make well-informed pricing and offer decisions. While it is feasible to navigate property transactions independently, the wealth of expertise, networks, and guidance that agents provide can significantly enhance the efficiency and success of your real estate endeavors.

Their negotiation skills ensure that you secure favorable deals, whether you are buying or selling property. Real Estate Agents can be hired by a seller or a buyer and typically paid 100% by the seller. The normal commission is 6% plus tax and can be negotiable for properties listed at higher prices (2M+). When there are two different agents involved in a transaction, per example one representing the buyer and one representing the seller, the commission is split 50-50 between both agents so each buyer and seller can have their own representative.

Who Foots the Bill? Understanding Buyer vs. Seller Responsibilities

In our area, it's customary for the buyer and seller to share the transfer tax and stamps, as well as the escrow fees. As a general guideline: If the market leans towards the buyer, or if a property has been up for sale for an extended period, you might have more leverage in negotiations about closing costs. On the other hand, when a hot real estate market favors the seller, market value sets the price and terms of the sale.

BUYER'S closing costs are typically as follow when the buyer transfer the property to a new corporation or to his own name:

- 1.25% + IVA (1.41% total) for the notary to do the due diligence, register the property in the National Property Registry and perform closing duties.

- 1.2% (Total 2.4% typically shared between buyer and seller) in government stamps and fees if you purchase a property in your own name or in the name of your own corporation.

- 0.15% + IVA (0.34% total) typically shared between buyer and seller) in Escrow fees commonly apply if you're going to use a third-party escrow.

- Other extra fees discussed above

SELLER'S closing costs are typically as follows:

- 0.50% + IVA (0.56% total) for the notary to do the due diligence and perform closing duties.

- 1.2% (Total 2.4% typically shared between buyer and seller) in government stamps and fees if you purchase a property in your own name or in the name of your own corporation.

- 0.15% + IVA (0.34% total) typically shared between buyer and seller) in Escrow fees commonly apply if you're going to use a third-party escrow.

- Other extra fees discussed above

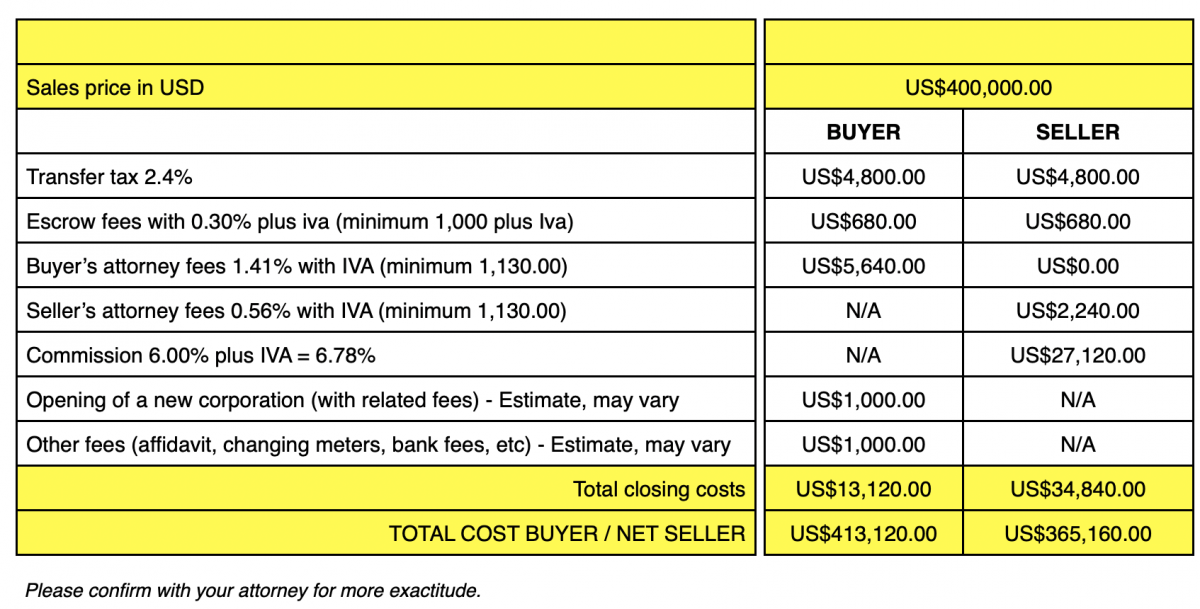

We made this calculator below to help our clients estimating how much they should expect to pay if they buy or sell their property. We took the example of a property selling for 400,000 for the exercise. The closing costs can sometimes involve many more details than this page can cover. It is very important to consult with an attorney in order to get the right calculations.

Navigating Costa Rican Real Estate with Confidence

Dive deeper than just closing costs with RE/MAX Ocean Surf & Sun. As a multilingual, culturally aware, and vastly experienced team, our primary focus is you. Whether you need assistance with property transfer fees, insights about family life in Costa Rica, or business investment advice, we're here to guide you. Envision your dream home, vacation getaway, or investment property. Consider your ownership plans, timeline, and price range. Then reach out to us. We promise a swift response. Explore Costa Rica's finest real estate offerings with us — from condos and homes to land and businesses. Connect with RE/MAX Ocean Surf & Sun today!